Most likely, your financing will come from a variety of sources. To add a little drama, we've put these in order from worst to best:

Merchant Cash Advance: The idea seems simple - get cash up front and pay 'em back over time through your credit card terminal, but the effective fees can be extremely high. In fact, to avoid state usury laws, Merchant Cash Advance companies like Rapid Advance, Advance Me, and Merchant Capital Source work really hard to make sure they never call what they are doing a "loan" but rather "cash-receivable financing". In any case, you'll be paying anywhere from 22% to 40% of your credit-card revenue until you've them back plus their fees.

Credit Cards: It can be tempting to apply for multiple just to get fast cash. Avoid this trap! Set realistic goals for yourself for how many credit cards and how fast you can pay them off, and stick to it. And don't be fooled by all those frequent flier miles. One rule of thumb for how to value these is a penny per mile. Thus an offer of 10,000 miles is actually worth only a $100 - hardly worth a ruined credit score and an interest rate of 25%.

Home Equity Loan/2nd Mortgage: A home equity loan uses your home as collateral, similar to a mortgage. With this kind of debt, you don't need to specify what purpose you're using the loan for, and can use it to build your start-up capital to get your business going. That said, you should approach this with extreme caution - if your restaurant goes out of business (as 59% do within the first three years) then you're out a job - and a house!

Peer-to-Peer Lending: Sites like lendingclub.com and prosper.com can help connect you to individuals who will lend you startup money. (It's a little more complicated - you are actually borrowing from an intermediary who is, in turn, offering a security to the lenders.) In any case, the average nominal interest rate borrowers pay is 13.8%.

Personal Savings: While it's great to start your business without taking on debt, dipping into your personal accounts is scary. If the restaurant goes south, then you'll be out of not only a job but also your savings.

Your Landlord: When you're shopping around for the ideal location for your restaurant, you may want to ask your landlord if you can strike a deal. In return for equity or a portion of the returns, he or she might be willing to reduce your rent.

Traditional Bank Loan: This is typically the first financing route pursued by restaurant owners. Navigating this process can be tricky as banks are wary of lending to first-time business owners, but if you do get a loan, interest rates can be fairly low (if you have enough assets to make the bank want to take a chance on you.) Budget a lot of time for the extended approval process and don't get too discouraged by rejections - at least you're getting helpful feedback from the reasons they cite and the questions they ask.

Credit Union Loans: With credit unions, interest is charged on the balance of the loan. So if you pay off a solid amount of the loan each month, the amount of interest you pay will go down as well. If for some reason you expect to make a lot of money initially, this can be an especially good option for financing.

SBA-Backed Loans: Thousands of banks offer competitive loan programs through the U.S. Small Business Administration. Through its 7(a) loan program, the SBA guarantees most of the value of the bank's loan, so lenders feel secure in making an otherwise risky investment. One thing to know in advance - you'll need to put up 20 to 30% of the cash up front. Again, that's something foodstart.com can help with. See here for more things to know before applying for an SBA 7(a) loan.

Also, a new option, SBA Express, provides loans of up to $350,000 with an approval window of 36 hours. The maximum duration is 7 years, but it has higher interest rates and shorter maturities than other SBA loans. Try to shop around and find the right SBA loan deal for you.

Finally, SBA Microloans are loans backed by the SBA for an average amount of $13,000 and must be paid within 6 years. The lender is obligated to help you start up your business- by providing training and guidance. These aren't common mainly because the lender is required to do much more at a smaller gain, but is definitely worth looking into.

A Loan from Friends and Family: This is a good source of funds if you can swing it. After all, these people know your passion and trust your instincts better than anyone else. Just make sure to lay out terms for the loan up front in writing. A note on selling equity or stock to family and friends - approach this with caution and think through if you really want to share operational control with a family member. Compared to equity, debt has pretty straightforward terms that can help minimize the chance for conflict.

High-Net worth Individuals: This is the dream, right? A few very rich people decide they want to back your concept. They won't call often but when they do, they'll give you great advice. But mostly they'll just write you a check and wish you the best. As great as that would be, restaurant consultants still say you're better off getting a lot of small investors rather than just one or two large ones. That way you get a network of people who want you to succeed. So even if you land a few big fish, consider supplementing those funds with a community-funding platform like foodstart.com.

Crowd Funding: This is approaching the general public for small amounts of money in exchange for perks or rewards. Though each individual person may not contribute much, compounded together it can add up to a lot of money. This can be a great marketing campaign as well- you can gain loyal customers before even you open! And instead of paying people back in cash, you pay them with discounts and free dessert. Try getting a Bank of America loan officer to agree to that!

There are a lot of crowd funding platforms to choose from but only one, foodstart.com, is designed just for the food-and-beverage industry. This focus allows them to offer exclusive benefits like insider market research, physical cards for backers, access to a network of experts, and social media marketing support. See below for details.

Introduction To Of Some Lower Cholesterol Foodstuffs

Cholesterol is a fat-like element contained in the physique

Introduction To Of Some Lower Cholesterol Foodstuffs

Cholesterol is a fat-like element contained in the physique

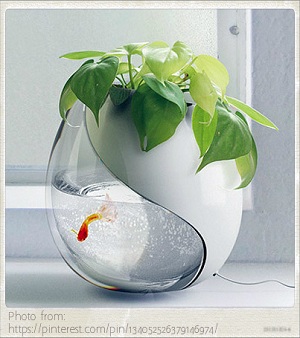

Starting Up An Aquaponics Set Up From See The Easy Way

Planting seeds in your aquaponics system can be a lot simpl

Starting Up An Aquaponics Set Up From See The Easy Way

Planting seeds in your aquaponics system can be a lot simpl

The Simplest Way To Lessen Your High Cholesterol By Natural Means

High-cholesterol is a major variable inside the countrywide

The Simplest Way To Lessen Your High Cholesterol By Natural Means

High-cholesterol is a major variable inside the countrywide