The US pet food manufacturing industry includes about 175 companies with combined annual revenue of $11 billion.

Large companies include divisions of Nestle (Nestle Purina PetCare Company); Procter & Gamble (Iams); Colgate-Palmolive (Science Diet and Prescription Diet); Mars (Pedigree and Whiskas); and Del Monte (9Lives, Gravy Train, Milk-Bone, and Meow Mix).

The industry is highly concentrated: the 50 largest companies hold almost 100 percent of the market.

Pet ownership drives demand. The profitability of individual companies depends heavily on effective marketing. Large companies have advantages of scale in manufacturing, marketing, and distribution. Small companies can compete effectively by offering specialized products or by serving a local market.

Pet food manufacturing is capital-intensive; average annual revenue per employee is over $700,000. The pet food industry is highly competitive, with large companies spending millions on marketing to maintain share.

Major products are dry dog food, canned cat food, dry cat food, and canned dog food. Dry dog food accounts for about 50 percent of industry revenue, canned cat food for 20 percent. Dry foods include semi-moist products.

Canned cat foods may be fish-based or meat-based. Other types of pet food include pet treats and food for birds; fish (fresh and saltwater); small animals; and reptiles.

Pet food manufacturing is a highly automated process that makes low-cost products. Ingredients are mixed, cooked, and canned, or may be extruded under heat and pressure, shaped, dried, and packaged.

Dies allow manufacturers to change the shape of products. Flavorings and additional nutrients for dried foods are often sprayed on after extrusion.

Major raw materials are grains (corn, wheat, soybeans); chicken meal; meat meal; fish meal; fats and oils; metal cans; and plastic or paper bags. Because many of the ingredients are waste products (like chicken feathers) from human food manufacturing operations, costs are low.

Companies buy most ingredients from commodity companies, grain cooperatives, and processors of meat byproducts (rendering plants).

Packaging represents almost 30 percent of costs. Technology in plastic material has allowed some companies to use pouches and plastic film, according to Food and Drug Packaging.

Plastic pouches are faster to sterilize and easier to open than cans. Plastic film bags can be resealed, and are more durable than paper bags. Although more expensive than paper, plastic packaging can be cut into different shapes and offers improved graphics.

Pet food companies invest significant amounts of capital in manufacturing equipment. Large plants can produce multiple products, and require skilled engineers and maintenance staff.

Small companies, without the financial resources, may use contract manufacturers, and have higher costs. Plants need to be close to both suppliers of raw materials and distributors to reduce freight costs.

Finished products are usually shipped from warehouses to customer distribution centers, retail stores, or regional pet supply distributors. Small companies often ship via a common carrier like UPS.

Distributor relationships are important for small companies that may lack the resources to service a large customer base. Protecting a company’s position with a distributor can be a challenge, as the average pet supply distributor stocks over 12,000 products

Uncovering Swift Plans For Alligator

Alligators include the most dangerous with the exotic pets.

Uncovering Swift Plans For Alligator

Alligators include the most dangerous with the exotic pets.

Bird Watching: Beautiful Birds Seen in Western Australia

Collection of Beautiful Bird

Bird Watching: Beautiful Birds Seen in Western Australia

Collection of Beautiful Bird

Attracting Birds to Feeders in Your Backyard

I assumed that it would be e

Attracting Birds to Feeders in Your Backyard

I assumed that it would be e

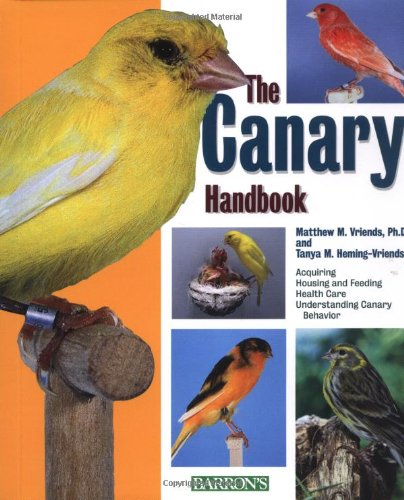

A Beginners Guide to Keeping Canaries

A Guide to Keeping CanariesC

A Beginners Guide to Keeping Canaries

A Guide to Keeping CanariesC

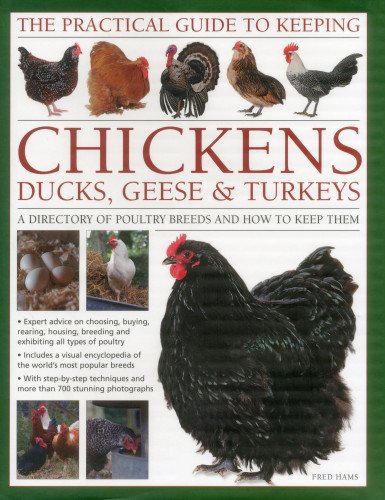

The Maran Chicken

Poultry BreedsThe Maran Chic

The Maran Chicken

Poultry BreedsThe Maran Chic